Looking back on it now, I was unequivocally unprepared for the process of becoming a founder. I say this with the benefit of hindsight obviously, but also because in my current job after meeting with many founders, I’ve devoted more time to thinking about the “profile” of a “good” founder (even exploring whether we could build predictive algos around this profile). I put these terms in quotations very deliberately because this profile does not exist. But that doesn’t mean there is nothing we can do to prepare ourselves to become or identify creative, high potential founders.

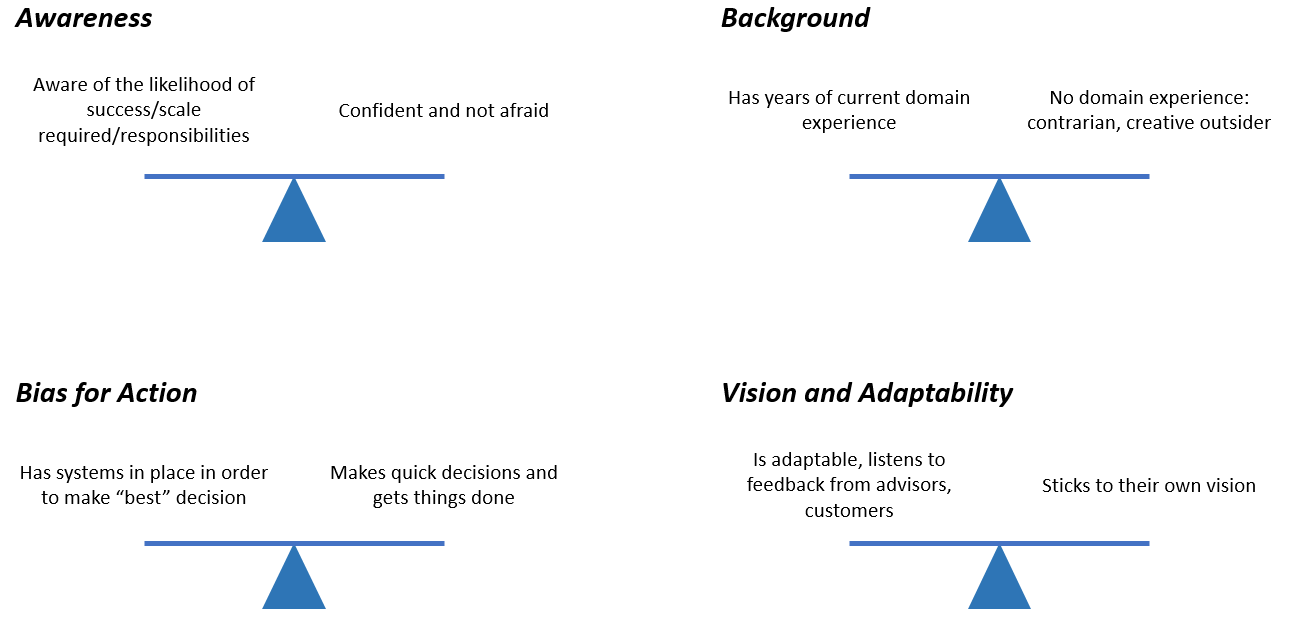

I want to outline how hard it is being a founder by exploring some of the things that we try and look for in the best ones. What we’re looking for is an idea of dynamic balance. I don’t mean work life balance (although that is important.) What I mean is, how do they manage two perhaps contradictory, and potentially both “good” responses to key questions, strategy directions, decisions etc.

Ben Horowitz hints at this idea in “The Hard Thing About Hard Things” when referring to CEO stress, saying CEOs make one of the following mistakes “1. They take things too personally, 2. They do not take things personally enough. The “right” response is highly context dependent; sometimes taking this personally is the “right” call sometimes not. What is important here is that the founder has the ‘dynamic balance’ to make this correct judgement.

For me the best way to think about it is using a fulcrum to visualize the competing response. The key founder criteria, with competing responses are shown below:

Let's investigate these a little further.

Awareness

In 'Make Your Bed' a deceptively simply titled book, former U.S. Navy Admiral William McRaven highlights the benefits of being "unshackled by fear." Founders need this too. But he also outlined how detailed and calculated each move they made was. The dynamic balance here is understanding the fact (more than just a cursory acceptance) that your company will most probably die and still being unafraid (and excited!)

Background

This one is really interesting. Jim Simons at Renaissance Technologies, arguably the best quant hedge fund in the history of the world, famously does not hire anyone out of Wall Street. He wants physics PhDs straight out of school because he doesn't want them to be 'corrupted' by the 'wrong' ways of making investment decisions.

MIT Professor Andrew Lo has a similar take on this; in his new book Adaptive Markets , he describes the scene of a shark thrashing about on the shore of a beach. Lo does this to illuminate how a creature of such (terrifying) hunting perfection can be reduced to ridicule simply by changing context. Now, this may be obvious, but the point here is to say the shark is so hyper-adapted to hunting in the ocean that it is useless on land. I say this to explore the idea of why Hilton didn't make Airbnb. Hilton (or any other global hotel chain) was so hyper-adapted to hunting in their context they missed (and arguably could never have seen or executed) on this multi-billion dollar opportunity.

So, depending on the market with which the founder is operating in we either tolerate (or indeed seek out) creative, contrarian outsiders or the market will necessitate domain knowledge (like building ML-specific ASICs for example.)

Bias for Action

Is decisive, takes action, makes decisions, fails fast, etc etc. versus has been deliberate about building the "communication architecture" as Ben Horowitz calls it around seeking feedback from team members, investors, advisers on important questions. Again, the idea here is that every situation will be different, what we want to diligence is the founders awareness of when to tip towards one or the other.

Vision and Adaptability

Andy Grove pivoted his huge, public company away from what they've been doing successfully for many, many years to save the entire company. This one for me is actually one and the same thing. You need to think of adaptions to support having a thriving, continuing vision; the shark needs to think if he'll ever needs legs.

There is no "right" answer to the dynamic balance on these questions and they change depending on may factors. But we believe this high level, translatable framework is helpful in learning more about how the founder will run her business in the future.

(also let’s talk! You can reach me at s.mcanearney@gmail.com and stephen@honecap.com)