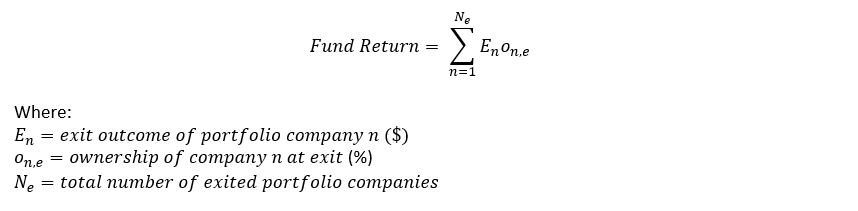

Returns from a VC fund are driven by the exit outcome of the underlying portfolio companies and the funds’ ownership of these companies at exit. For seed stage, it is common to model the company level returns using a power law. The first sentence above can be represented as the following (leaving the representation of the power law aside for the moment):

Ownership at exit can also be represented as:

As is clear, the fund returns are just the sum of contributions from exited portfolio companies; the exit value of company n multiplied by ownership at exit of company n. The interesting thing to note here is that if exit ownership is reduced linearly (either through smaller initial check size or greater pro rata based dilution) for returns to be the same, the size of the exit En (in $) must compensate and be higher. But this is exponentially less likely since we are in a power law environment. A large En (the ‘unicorn’ scenario) is the scarce element in this power law environment and (generally) not the ownership at seed.