A wise man once told me that a business is just a group of people. We have a tendency to think of some very successful companies as larger than life for many reasons (like the "taste the feeling" ephemeral joy of Coca Cola or the minimalist sophistication of Apple.) But history is littered with once vaunted companies that suffered leadership complacency or willful blindness in the face of change.

What I want to explore here however, is the network element of the "group of people" description of a business. We will see how valuable the network was to leadership roles in new startups and new investment opportunities for early VC funds. The 1950 - 1985 period of U.S. and Silicon Valley history is immensely rich network effects permeating the birth of the "minicomputer" to the development of synthetic insulin.

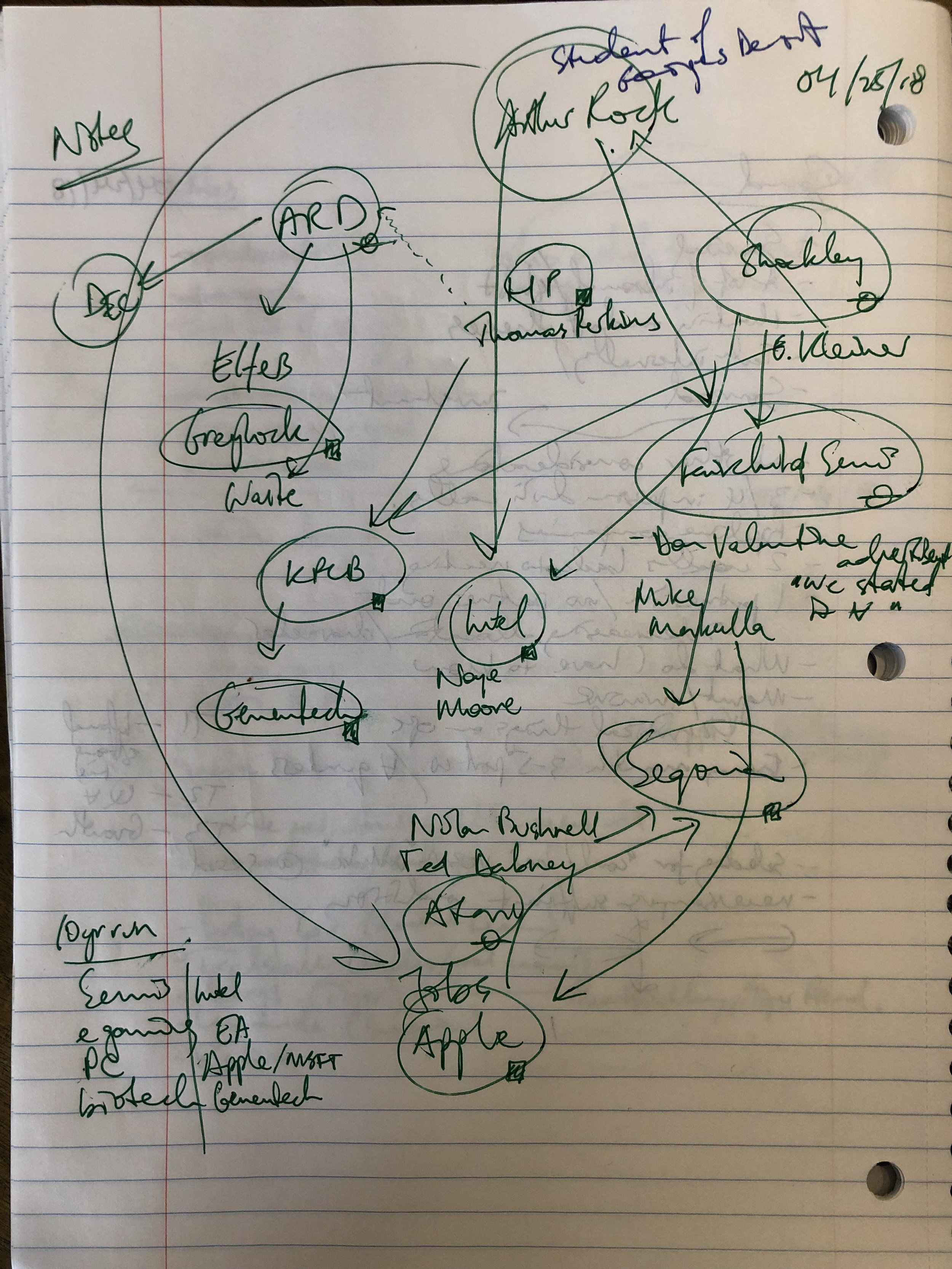

There are incredible resources that explore in more detail the narratives behind these networks (see notes at end.) Below is a concise filtering of the key network elements in rough chronological order and a diagram for further effect.

Timeline:

- HBS Professor Georges Doriot ("the General") created the first modern venture fund in the U.S called American Research and Development (ARD) on June 6, 1946 [1].

- In 1956, Nobel Laureate and inventor of the transistor, William Shockley created Shockley Semiconductor. In 1957 the "traitorous eight" left Shockley to create their own firm [2]

- Arthur Rock, who was a student of Georges Doriot at HBS was introduced to these eight engineers by Eugene Kleiner (yes THAT Kleiner) whose Father had a brokerage account with Rock's firm. Arthur Rock convinced Sherman Fairchild to provide the capital to create Farichild Semiconductor [1].

- So many new companies, like AMD, were created from Fairchild alums they were called the "Fairchildren" [2] - analagous to the TIger Cubs in the hedge fund industry

- In 1957 Doriot and ARD's big win was Digital Electronics Corporation, an early computer and software developer.

- During succession discussions, Doroit reached out to Thomas Perkins at HP - Perkins would later create KPCB with Eugene Kleiner [1].

- In 1965 William Elfers who worked as Doroit's "right hand man" left ARD to create his own venture fund; Greylock Partners (based on east coast, they only opened their first Silicon Valley office in 1999) [1].

- In 1968, Gordon Moore and Robert Noyce (part of the Shockley "traitorous eight") left Fairchild to create Intel - funded again by Arthur Rock.

- In 1972 ex Fairchild marketing executive Don Valentine created Sequoia Capital.

Don Valentine (Sequoia) in front of early Apple advertisement

- Atari founders Nolan Bushnell and Ted Dabney (who met at the widely successful Ampex along with employee number 1, Al Alcorn) reached out to Sequoia partner Valentine in 1972

- In 1972, Eugene Kleiner (former Shockley and Fairchild engineer) and Thomas Perkins (from HP) created Kleiner Perkins

- In 1975, ex-Atari employee Steve Jobs was introduced to Valentine at Sequoia. Valentine thought Jobs and Wozniak needed a more business minded 3rd co-founder so he brought in a former Fairchild colleague, Mike Markkula.

- In 1975, Robert Swason was a former VC looking to form a company. He had heard about an exciting new technology, recombinant DNA and got his hands on a list of industry professionals who had attended an international conference in this field. He began cold calling scientists on this list alphabetically. Robert Boyer (B) was the first to agree to take the call [3]

- Robert Swanson pitched his former boss Thomas Kleiner for $500k. Kleiner Perkins invested $100k and they created Genentech (Gen-etic -En-gineering Tech-nology) [3]

Now, a couple points from the above network. There are a number of instances where new people were introduced to the network with limited connections or personal history (Atari founders to Valentine, Robert Swanson cold calling scientists etc.) So even though the power of networks here is self evident, there are exceptions for exceptional people [See the John Doerr - Amazon bonus note below.]

Second, working at Fairchild (or in any other part of this network) was not a necessary, nor sufficient condition for building a successful startup in this period. It took an intense amount of hard work and (probably) equal parts luck. But investors in startups often talk about reducing risk as much as possible. Perhaps being in this network was a tangible risk reducer.

Think about Valentine's investment in Apple. He didn't invest directly, he brought in Mike Markkula (who he must have trusted given his professional relationship) because Valentine though Jobs and Wozniak didn't have "any sense of the size of the market, they weren't thinking anywhere near big enough". Even after bringing in Markkula, Valentine only invested in the next round [1].

Bonus:

- In 1995, former Intel executive and Kleiner Perkins Partner John Doerr invested in Amazon founded by Jeff Bezos

- In 1998, Jeff Bezos invested in the Angel round of Google

- Less than a year later the Series A was led by.... John Doerr at Kleiner Perkins.

- How did Jeff Bezos get to John Doerr? Well it was actually the other way around. Listen to this podcast where Madrona Partner and lead investor in Amazon seed round Tom Alberg describes the connection:

- Tom Alberg was on the Vizio Board with one of Doerr's Partners

- Alberg got home one night and his wife said "someone called John Doerr has been calling every 15 minutes and says he needs to speak to you now!"

- Such an awesome story... not the power of networks but the power of persistence!

Notes:

- [1] Creative Capital - Georges Doroit and the Birth of Venture Capital, Spencer E. Ante

- [2] Troublemakers, Leslie Berlin

- [3] The Gene, Siddhartha Mukherjee